|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance with 680 Credit Score: Exploring Your Options and OpportunitiesIf you're considering refinancing your mortgage with a 680 credit score, you're not alone. Many homeowners find themselves in a similar position, wondering if they can secure better terms and lower interest rates. In this article, we'll delve into the possibilities and challenges of refinancing with a 680 credit score, offering practical advice to guide your decision-making process. Understanding Credit Scores and RefinancingYour credit score plays a crucial role in determining your eligibility and the terms you might receive when refinancing. A 680 credit score falls into the 'fair' category, which means you have several options but might face higher interest rates compared to those with 'excellent' scores. Impact on Interest RatesWhile a 680 credit score might not qualify you for the lowest rates available, it is still possible to obtain a competitive rate, especially if you demonstrate consistent financial stability and a good payment history. Lenders will assess your overall financial picture, so it's essential to present your strengths. Factors Lenders Consider

Pros and Cons of Refinancing with a 680 Credit ScorePros

Cons

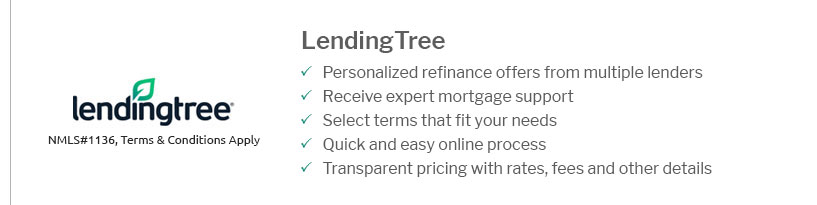

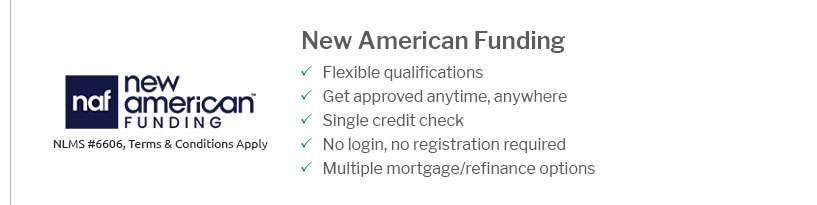

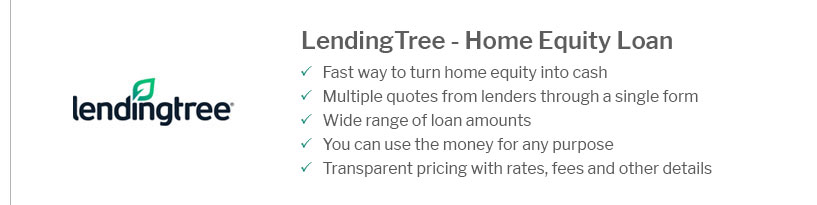

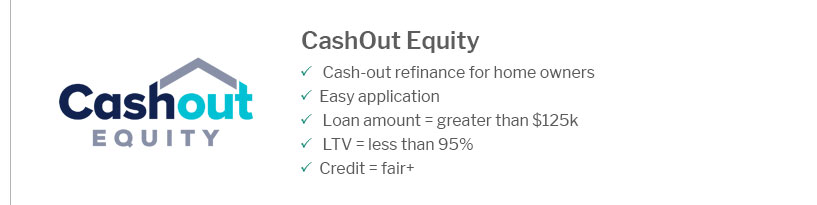

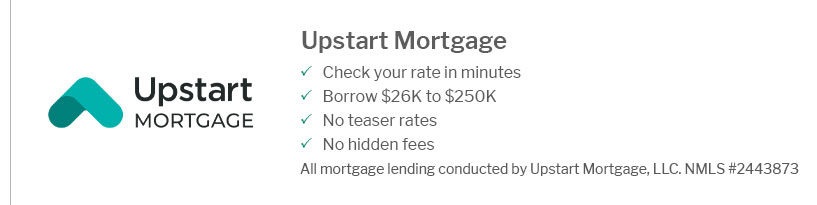

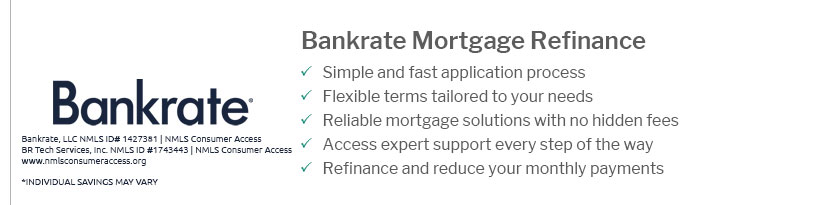

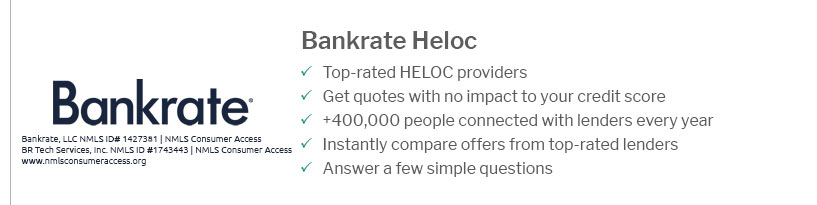

For those exploring refinancing options, consider visiting alaska usa home refinance rates to compare current offers that may suit your financial needs. Practical Tips for Refinancing with a 680 Credit ScoreImprove Your Credit ProfilePrior to applying, work on paying down existing debts and avoiding new credit inquiries to boost your score. Shop Around for LendersDifferent lenders offer varying terms, so it's wise to compare multiple offers. You might find a deal that aligns well with your financial goals. Consider Streamlined OptionsPrograms like FHA Streamline Refinance can be beneficial if you meet the criteria. You can apply for fha streamline refinance for a potentially easier process. FAQCan I refinance with a 680 credit score?Yes, you can refinance with a 680 credit score. While you may not qualify for the lowest rates, many lenders offer options for borrowers in the 'fair' credit range. What are the benefits of refinancing with a 680 credit score?Refinancing can offer access to cash-out options and the potential for better loan terms, even if your credit score is 680. It's crucial to weigh these benefits against any potential downsides, such as higher interest rates. How can I improve my chances of approval?To improve your chances of approval, focus on reducing your debt-to-income ratio, maintaining a stable employment history, and building up equity in your home. Additionally, improving your credit score through responsible financial habits can enhance your prospects. https://www.rocketmortgage.com/learn/refinance-mortgage-requirements

The typical minimum credit score to qualify for a 30-year fixed jumbo loan refinance is 680. However, lenders may require up to 740 for 15-year fixed loans or ... https://refi.com/credit-score-requirements-to-refinance-home/

For most conventional refinance loans, lenders typically require a credit score of at least 620. If you're considering other loan types, the minimum scores can ... https://themortgagereports.com/18447/fico-credit-score-home-buyer-mortgage-rates

A 680 credit score is high enough to qualify for most major home loan programs. That gives you some flexibility when choosing a home loan.

|

|---|